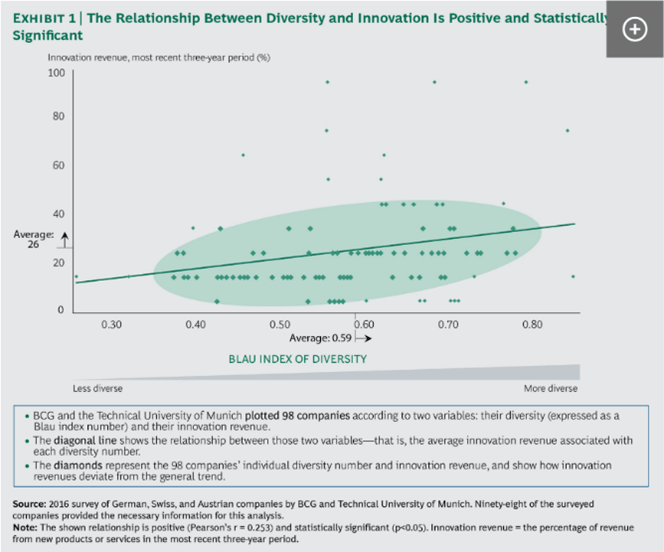

There is a growing body of evidence to suggest that companies that focus on Diversity, Equity and Inclusion (DEI) tend to financially outperform, and be more innovative, than their peers. According to research by Boston Consulting Group, there is a material positive correlation between the diversity of the team and innovation. McKinsey has also concluded that companies that are in the top quartile for ethnic and gender diversity yield 33% and 21% greater financial returns respectively relative to bottom quartile companies (see charts below).

Source: https://www.bcg.com/publications/2017/people-organization-leadership-talent-innovation-through-diversity-mix-that-matters

Source:https://www.mckinsey.com/~/media/mckinsey/business%20functions/organization/our%20insights/delivering%20through%20diversity/delivering-through-diversity_full-report.ashx

DEI as a category is generating a lot of attention in the technology ecosystem. Workday acquired Peakon for $700M USD to add DEI competency to their product portfolio, while Netflix released their first DEI report.

There are hundreds of start-ups popping up in the DEI space and there are an increasing number of resources for early stage companies to think with a DEI mindset from the beginning. Ellen Pao is co-founder of Project Include which provides start-ups with a set of resources to create diverse and inclusive companies from the beginning. Pao advises start-ups to set 10-10-5-45 targets. “The first two are to aim for 10 percent black and 10 percent Latinx employees” and five percent should represent gender non-binary, and 45 percent should be people who identify as women.1

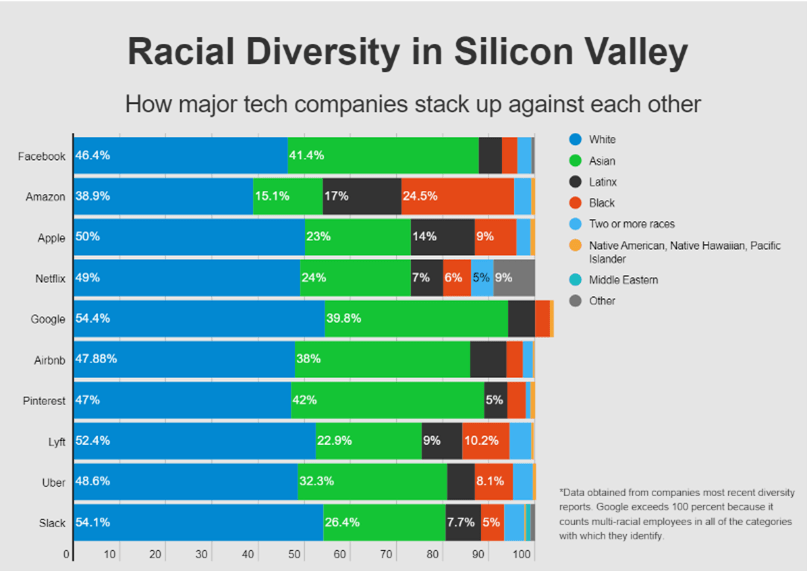

This early target setting is critically important because as Facebook’s head of DEI, Maxine Williams, says, “the later you start, the harder it is”. Facebook was nine years old when it started to focus on DEI, which meant that despite hiring 25x the number of black women and 10x the number of black men over the last five years, those efforts have barely made a dent as a proportion of the whole (see chart). 1

This early target setting is critically important because as Facebook’s head of DEI, Maxine Williams, says, “the later you start, the harder it is”. Facebook was nine years old when it started to focus on DEI, which meant that despite hiring 25x the number of black women and 10x the number of black men over the last five years, those efforts have barely made a dent as a proportion of the whole (see chart). 1

1 Source: https://techcrunch.com/2019/06/17/the-future-of-diversity-and-inclusion-in-tech/

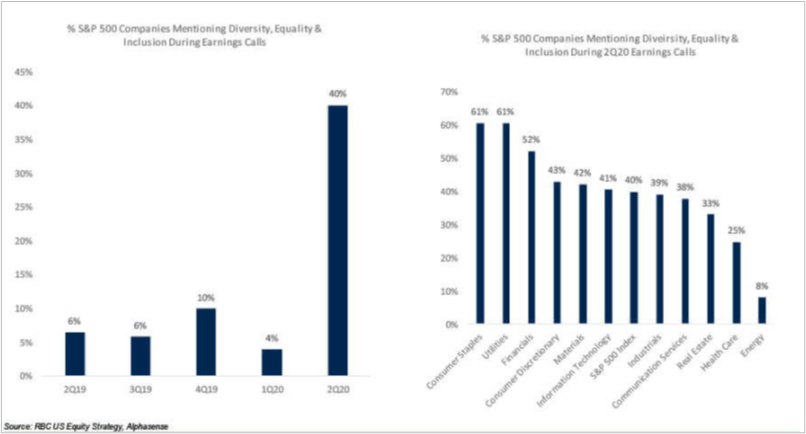

Greater financial performance, more innovation, and major shifts in awareness of the challenges that minorities face has led investors to call for better visibility and reporting. The number of S&P 500 companies that are reporting on DEI during earnings calls shot up to 40% by Q2 2020 from less than 10% in the previous quarter (see chart below).

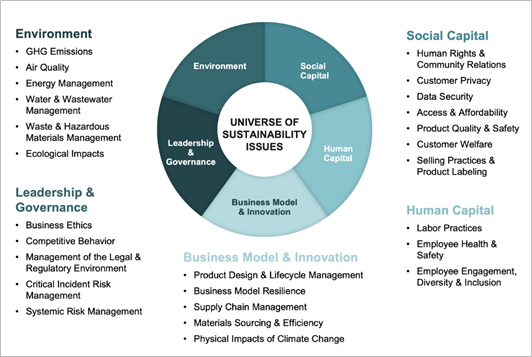

However, DEI is just a subcategory of Environmental, Social and Corporate Governance (ESG), which means for many companies, requests for reporting go beyond DEI to include many other key business areas (see chart below).

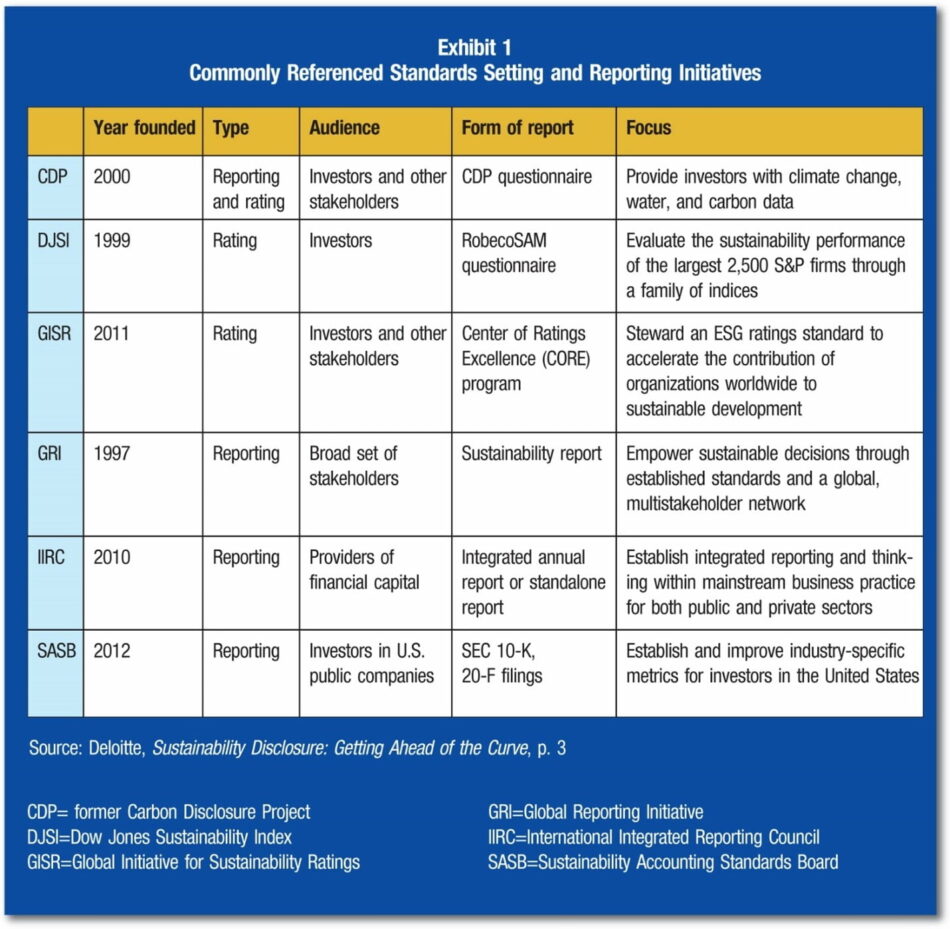

The United States Government Accountability Office (GAO) released a report in June 2020 discussing some of the challenges companies face with public disclosures for ESG initiatives. GAO interviewed a number of large and mid-sized institutional investors, public companies and market observers, such as academics, NGOs and standards bodies. The complication that many investors and companies highlighted is the lack of standardization for what, where and how ESG gets reported. There is also little consistency in the lens companies are supposed to use for reporting. For instance, the Global Reporting Initiative (GRI) metrics are used to show the impact companies have on the world, while Sustainability Accounting Standards Board (SASB) metrics are used to show how the world impacts companies (see chart below for common reporting standards).

There is a lot of work ahead for large companies, small companies, and investors alike as we navigate how this new information informs our investment decisions. At Pender, we are proud of the fact that 40% of our portfolio companies have diverse management teams, and that we ourselves are a diverse investment team. We believe the diversity of our experiences from investors to entrepreneurs, as well as our gender and race, gives us an edge in what and how we evaluate potential investments. For Pender Ventures, our focus on DEI and ESG is based on the UN’s Sustainable Development Goals 3, 5, 8, 9, 10, 12:

Lastly, our focus on diversity, inclusion and ESG is a Pender wide effort. We as a firm must ensure we walk-the-talk, and in that regard we have 1) recently established an internal diversity and inclusion committee with members from across our organization, and 2) have become signatories to two leading associations in the field – UNPRI and RIA.

Kristina Bergman, M.Sc.